What Does FOB Mean?FOB Comprehensive Guide

What Does FOB Mean?FOB Comprehensive Guide

Blog Article

If you are engaged in international shipping, or international trade, you’ve likely encountered the term FOB – but what does FOB mean exactly?

I believe that reading this article can solve your following confusions:

- What is FOB stand for in shipping?

- How is FOB price calculated?

- What are the buyer’s vs. seller’s obligations?

- How to avoid common FOB pitfalls?

1. What Does FOB Mean?

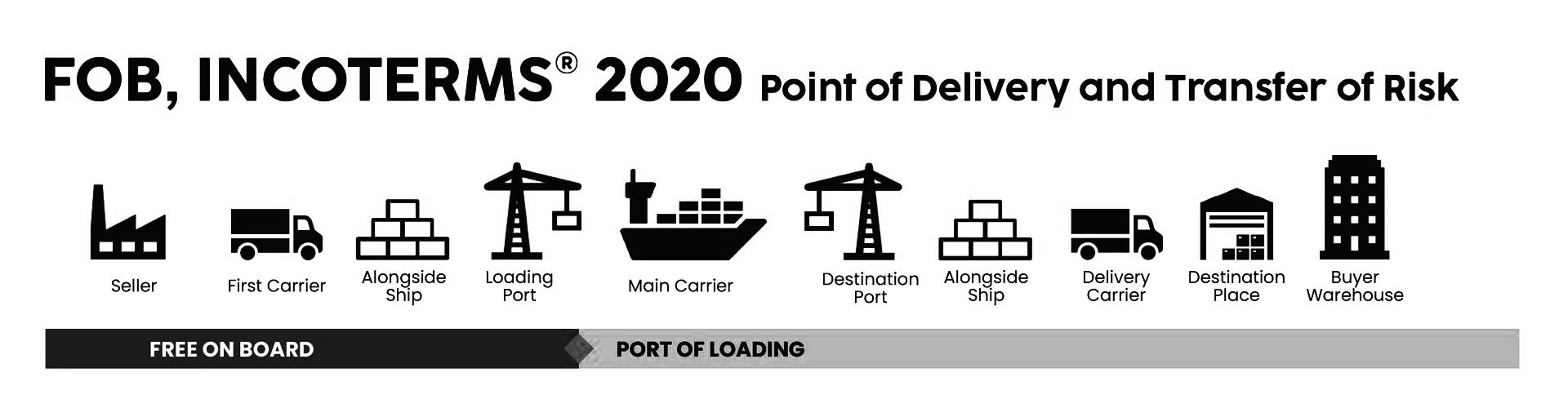

FOB stands for Free On Board, a legal term codified under the Incoterms® 2020 rules by the International Chamber of Commerce (ICC). It applies exclusively to sea or inland waterway transport.

- Core Meaning:

The seller fulfills its obligation to load the goods safely onto the vessel at the designated port of shipment.After this point, all risks and costs transfer to the buyer.

- Historical Context:

FOB originated in 19th-century British maritime law, where goods were considered “free” of seller responsibility once placed on board. Modern Incoterms® have standardized its global interpretation.

The Incoterms® Rules are protected by copyright owned by ICC. Further information on the Incoterms® Rules may be obtained from the ICC website iccwbo.org

2. What is FOB Price? FOB Calculation

FOB price meaning refers to the total cost incurred by the seller to deliver goods onto the vessel. It does NOT include ocean freight or insurance, which are the buyer’s responsibility.

Components of FOB Price:

- Product Cost: Manufacturing or procurement expenses.

- Inland Transportation: Moving goods from factory to port.

- Export Duties & Customs Clearance: Fees for export licenses, documentation, and compliance.

- Loading Fees: Charges for placing goods onto the ship (e.g., crane operations, terminal handling charges).

FOB Price = Cost of Goods (Production/Purchase) + Pre-Shipment Expenses (Domestic Transportation Fees + Export Clearance Fees + Shipping Fees) + Seller's Target Profit

3-Step FOB Price Calculation (with Tax Rebate)

- Post-Rebate Product Cost

Product Cost × (1 - Tax Rebate Rate) - Add Fees & Profit Margin

(Post-Rebate Cost + Domestic Transportation Fees + Export Customs Clearance Fees + Loading Charges at Port) ÷ (1 - Profit Margin) - Convert to Foreign Currency

Result from Step 2 ÷ Exchange Rate = FOB Price in Target Currency

Key Terms:

Tax Rebate Rate: Government refund rate for exported goods (e.g., 13% in China).

Profit Margin: Seller’s expected profit ratio (e.g., 15% margin = 0.15).

Exchange Rate: Currency conversion rate (e.g., USD/CNY).

key notes: When choosing FOB, be sure to specify currency conversion and confirm local charges with your logistics partner.

3. Division Of Responsibilities: Seller vs. Buyer

Seller’s Obligations (Before Loading):

- Deliver goods to the port and load them onto the vessel.

- Handle export licenses, inspections, and customs formalities.

- Provide commercial invoice, packing list, and proof of delivery (e.g., Bill of Lading).

Buyer’s Obligations (After Loading):

- Arrange and pay for ocean/waterway transport.

- Purchase marine insurance (optional but recommended).

- Handle import clearance, duties, and final delivery.

Risk Transfer Point: Under Incoterms® 2020, risk shifts from seller to buyer once goods are fully loaded and secured on the ship.

4. FOB Operational Guide: 6-Step Process

Here’s how to execute an FOB shipment smoothly:

Step 1: Contract Agreement

- Specify “FOB [Port]” (e.g., FOB Rotterdam) in the sales contract.

- Clarify who covers loading charges (e.g., THC) to avoid disputes.

Step 2: Seller Prepares Goods

- Pack goods according to shipping standards.

- Book inland transport to the port.

Step 3: Buyer Books Vessel

- The buyer (or their freight forwarder) reserves cargo space and shares shipping instructions.

Step 4: Export Customs Clearance

- Seller submits export declarations, pays local taxes, and obtains necessary permits.

Step 5: Loading onto Vessel

- Seller delivers goods to the port and loads them onto the ship.

- The copyright issues a Bill of Lading as proof of shipment.

Step 6: Post-Loading Actions

- Seller sends shipping documents (invoice, B/L) to the buyer.

- Buyer arranges insurance, pays freight, and prepares for import.

5. FOB vs. Other Incoterms®When to choose FOB?

| Term | Risk Transfer | Cost Responsibility | Best For |

|---|---|---|---|

| FOB | At port of shipment | Seller pays until loading; buyer covers freight/insurance. | Buyers wanting control over shipping costs. |

| CIF | At port of shipment | Seller pays freight + insurance; buyer handles import. | Sellers offering door-to-port convenience. |

| EXW | At seller’s warehouse | Buyer handles all logistics. | Buyers with strong logistics networks. |

When to choose FOB?

- The buyer wants to negotiate freight rates directly.

- The seller lacks expertise in international shipping.

6. Common FOB Questions and Pitfalls

FAQ 1: What is FOB stand for in insurance?

FOB doesn’t mandate insurance. Buyers often purchase Marine Cargo Insurance separately to cover transit risks.

FAQ 2: Can FOB be used for air freight?

No. For air shipments, use FCA (Free copyright) instead.

FAQ 3: Who pays for damaged goods during loading?

If damage occurs before risk transfer (e.g., goods dropped while loading), the seller is liable.

Top Pitfalls to Avoid:

- Late Shipping Instructions: Buyers must book vessels early to prevent demurrage fees.

- Unclear Loading Costs: Specify whether FOB includes “THC” or “terminal fees” in the contract.

- Poor Documentation: Missing or incorrect Bills of Lading can delay cargo release.

7. Why FOB Matters in Global Trade

1. Clear Risk Allocation

Under Incoterms® 2020, risk transfers to the buyer once goods are loaded onto the vessel. Sellers are exempt from liability for transit risks (e.g., damage, delays).

2. Cost Efficiency for Buyers

Buyers gain autonomy to negotiate competitive freight rates, optimize shipping routes, and avoid hidden costs from sellers’ logistics partners.

3. Flexible Supply Chain Division

Sellers focus on production and export compliance, while buyers manage international logistics and final delivery, enabling specialized efficiency.

4. Legal Standardization

Globally recognized Incoterms® rules ensure consistent interpretation of FOB terms, minimizing disputes over obligations (e.g., customs clearance, liability).

5. Improved Cash Flow Management

Sellers secure payment earlier (typically upon shipment), while buyers defer freight and insurance payments until goods are in transit, balancing financial pressures.

6. Mitigation of Geopolitical Risks

Sellers avoid liability for destination-related risks (e.g., port congestion, policy changes, or transit route disruptions).

7. Lower Barriers for SMEs

Simplifies export processes for sellers (no need for logistics expertise) and allows buyers to scale shipments flexibly, empowering SMEs to engage in global trade.

Conclusion

Understanding what does FOB mean and how FOB price works is critical for anyone in global trade. By mastering responsibilities, cost structures, and operational steps, you can minimize risks and build smoother supplier relationships.

Need Help with FOB Shipments? Contact our logistics experts for a free consultation to avoid costly mistakes.